The Legal Status of Privacy Coins in Vietnam

With a growing interest in cryptocurrencies and a flourishing digital economy, many investors and users in Vietnam are keen to understand the legal status of privacy coins within this dynamic market. But what exactly does this entail? Vietnam’s embrace of blockchain technology, alongside its traditional views on privacy and security, creates a complex environment for such digital assets. In this guide, we will delve into the current legal standing of privacy coins in Vietnam, exploring the implications for users and businesses alike.

An Overview of Privacy Coins

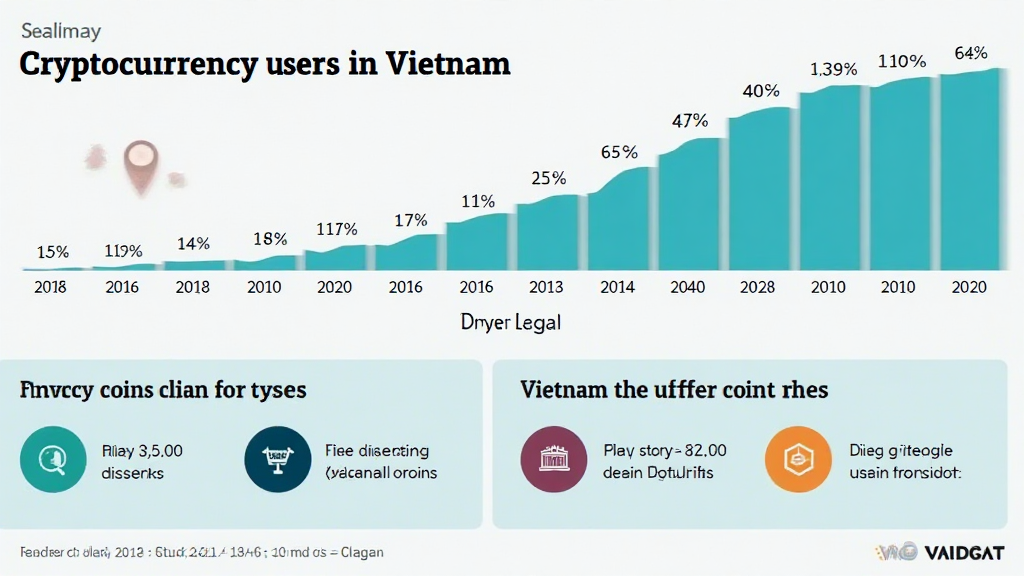

Privacy coins represent a unique category of cryptocurrencies designed to enhance the anonymity of transactions. By obscuring sender and receiver information and transaction amounts, they offer a level of security that standard cryptocurrencies like Bitcoin do not provide. Examples include Monero (XMR), Zcash (ZEC), and Dash (DASH). In Vietnam, as of 2023, the cryptocurrency market has seen a significant increase in users, growing at a rate of 45% per year.

Understanding Vietnam’s Regulatory Framework

In 2018, the State Bank of Vietnam explicitly stated that cryptocurrencies are not considered legal tender, which established a clear regulatory stance against the use of these digital currencies in traditional financial transactions. However, this does not eliminate the interest or use of privacy coins among Vietnamese users. As per the Hibt.com report, about 12% of total cryptocurrency transactions in Vietnam involve privacy coins.

The Legal Landscape: Challenges and Criticisms

The legal status of privacy coins in Vietnam presents several challenges. The prevalent perception is that such coins may promote illicit activities, including money laundering and tax evasion. The Ministry of Finance is currently drafting regulations aimed at curbing the use of cryptocurrencies in these contexts. Therefore, this presents a significant roadblock for privacy coins given the regulatory scrutiny they are under.

- Opaque Transaction Processes: Privacy coins can often mask transaction origins, raising concerns over regulatory compliance.

- Consumer Protection Risks: Vietnamese users may lack adequate protection against fraud associated with privacy-focused trades.

- Future Regulatory Changes: Potential regulations could change the landscape rapidly, urging users to stay informed.

The Role of Blockchain Security Standards

As Vietnam prepares for the future of its cryptocurrency regulation, discussions surrounding tiêu chuẩn an ninh blockchain (blockchain security standards) become increasingly critical. This includes verifying identities, ensuring transactional transparency without compromising security, and addressing the unique community standards for cryptocurrencies.

What Does the Future Hold for Privacy Coins in Vietnam?

Anticipating 2025, it seems likely that Vietnam will continue to evolve its regulatory approach. If we look at the international landscape, many countries are beginning to embrace blockchain technology and privacy coins in a regulated manner. Compliance-focused privacy coins could minimize regulatory risks while satisfying user needs for security.

Advice for Investors and Users

Before diving into the world of privacy coins in Vietnam, it’s crucial for users to:

- Conduct comprehensive research on potential legal changes.

- Utilize secure wallets, such as Ledger Nano X, which significantly reduce hacking risks by 70%.

- Stay updated on consumer protection measures and community guidelines for trading privacy coins.

Conclusion

In closing, while privacy coins face significant regulatory challenges within Vietnam, the growth of digital transactions indicates a continuous interest that may drive future changes in the legal framework. Users should remain vigilant, informed, and prepared for shifts in regulatory policy that could affect their ability to use these assets. For more insights about cryptocurrency and market trends in Vietnam, visit suzukicoin.

Author: Dr. Anh Nguyen, crypto regulatory expert and contributor to numerous research papers on blockchain technology and compliance. He has also led audits for leading projects in the digital asset space.