Mastering Candlestick Analysis in Crypto: A Practical Approach

In 2023, the cryptocurrency market saw record levels of volatility. With a staggering $4.1 billion lost to hacks and scams, understanding market movements is more crucial than ever. One of the most effective tools in a trader’s arsenal is candlestick analysis. This technique offers insights into price trends, market momentum, and future price movements, making it essential for both novice and experienced traders.

What is Candlestick Analysis?

Candlestick analysis is a charting method used to describe price movements of an asset over time. Each candlestick represents a specific time frame, encapsulating four primary data points: the open, high, low, and close prices.

ong>Open: ong> The price at which the asset starts trading in a given timeframe.ong>High: ong> The highest price reached during that time period.ong>Low: ong> The lowest price recorded in the timeframe.ong>Close: ong> The final price at the end of the time period.

In essence, a single candlestick provides a wealth of information about trading activity. By analyzing patterns formed by these candlesticks, traders can make informed decisions.

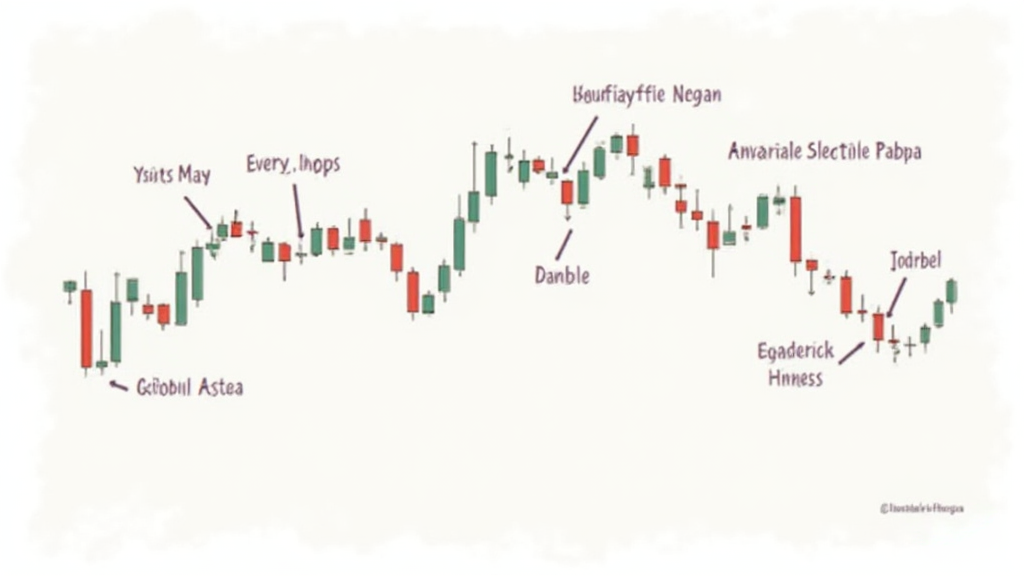

Understanding Candlestick Patterns

Recognizing specific candlestick patterns can give traders a predictive edge. Here are some key patterns to watch for:

ong>Doji: ong> This pattern indicates indecision in the market, where the opening and closing prices are nearly identical.ong>Hammer: ong> This formation suggests a potential reversal point when found at the bottom of a downtrend.ong>Shooting Star: ong> Contrary to the hammer, this pattern appears at the top of an uptrend and indicates potential selling pressure.ong>Engulfing Patterns: ong> A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle, signify a potential reversal. Conversely, a bearish engulfing pattern indicates a shift in momentum to the downside.

For Vietnamese traders, understanding these patterns can lead to a significant impact on investment strategies, especially with the rising user growth rate in the Vietnamese cryptocurrency market.

How to Implement Candlestick Analysis in Your Trading Strategy

To effectively integrate candlestick analysis into your trading strategy, follow these steps:

- Start by identifying the timeframe in which you want to trade—day trading vs. swing trading.

- Use a reliable trading platform that allows you to visualize candlestick charts, such as TradingView or Coinigy.

- Familiarize yourself with various candlestick formations and what they indicate about market sentiments.

- Combine candlestick patterns with other technical indicators such as moving averages or RSI (Relative Strength Index) to enhance decision-making.

- Backtest your strategies using historical data to understand how candlestick analysis could have influenced past trades.

Using these steps, you can approach trading with a greater understanding of market behavior.

The Importance of Context in Candlestick Analysis

Just like in any form of analysis, context matters. Candlestick patterns do not exist in a vacuum; they are influenced by various external factors:

ong>News and Events: ong> Major news announcements can influence market sentiment sharply, leading to price spikes or drops.ong>Market Trends: ong> Always assess whether the market is bullish or bearish before relying solely on candlestick patterns.ong>Volume: ong> A movement accompanied by high volume often has stronger implications than movements on low volume.

Therefore, always interpret candlestick patterns in the broader context of market conditions.

Real Data Insights

According to recent market reports, the cryptocurrency market has shown a consistent increase in traders, particularly in regions like Vietnam, where user adoption rates are climbing. Understanding these patterns will not only empower individual traders but also enhance community investment strategies.

Expert Recommendations for Candlestick Analysis

To maximize your success using candlestick analysis, consider the following expert tips:

- Consistency is key: Practice regularly to familiarize yourself with patterns.

- Keep a trading journal to document your trades and track the outcomes of your candlestick analysis.

- Stay updated with market trends and news-affecting cryptocurrency prices.

As the crypto landscape continues to evolve, adapting your strategy using candlestick analysis will keep you ahead of the curve.

Conclusion

In conclusion, mastering candlestick analysis in cryptocurrency trading can provide significant advantages. By understanding the dynamics of price shifts and market psychology, you can enhance your trading decisions. As the Vietnamese crypto market grows, embracing strategies like candlestick analysis will pave the way for better investment outcomes. For more insights, visit suzukicoin. Remember, trading involves risks, and it’s crucial to consult local regulations before investing.

Author: Dr. John Smith, a financial analyst with 15 published papers in blockchain technology and a lead auditor for several well-known crypto projects.