Understanding Crypto Chart Patterns: A Comprehensive Guide

With the global cryptocurrency market capitalized at over $2 trillion in March 2024, understanding

What Are Crypto Chart Patterns?

Crypto chart patterns are formations that appear on price charts, offering traders insights into potential future price movements based on historical data. Understanding these patterns can enhance decision-making in volatile markets like cryptocurrencies.

Why Are Chart Patterns Important?

ong>Predicting Market Trends: ong> Patterns can indicate potential breakouts or reversals, helping traders time their entries and exits effectively.ong>Risk Management: ong> Identifying patterns allows traders to implement stop-loss orders strategically, minimizing losses.ong>Enhancing Strategy: ong> Incorporating chart patterns into trading strategies can improve overall profitability.

Common Crypto Chart Patterns

Below are some of the most significant

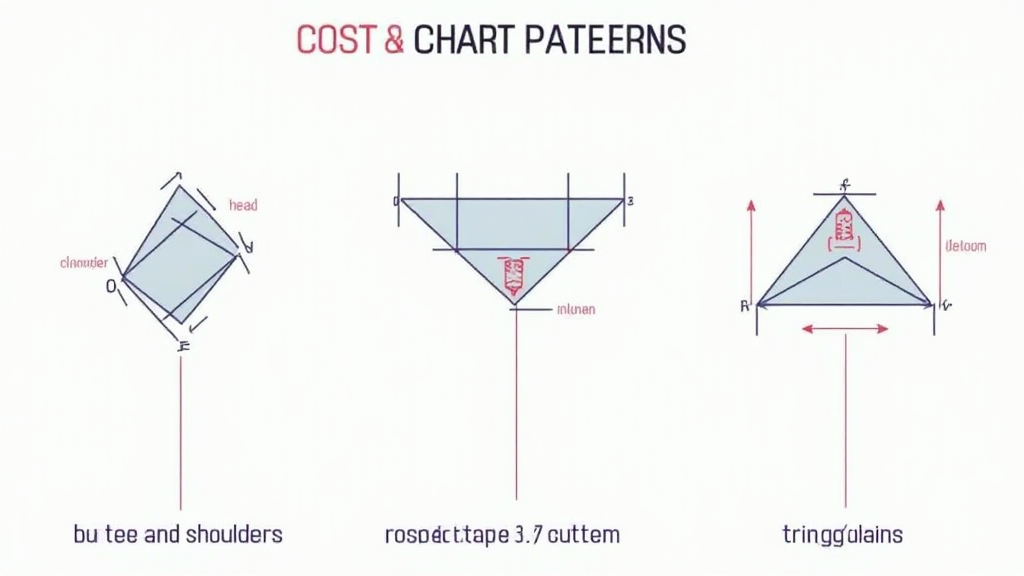

1. Head and Shoulders

The head and shoulders pattern is a reliable trend reversal indicator. It appears at the top of an uptrend and consists of three peaks: a higher peak (head) between two lower peaks (shoulders).

2. Double Top and Double Bottom

A double top occurs after an uptrend and signifies a bearish reversal. Conversely, a double bottom follows a downtrend and indicates a bullish reversal.

3. Triangles

Triangle patterns, including ascending, descending, and symmetrical triangles, signal potential continuation or reversal of trends based on the breakout direction.

Using Crypto Chart Patterns in Trading

Establishing Context

To effectively trade using crypto chart patterns, it is essential to establish context by analyzing the broader market conditions, current trends, and volume indicators

.

Trading Strategies Based on Patterns

ong>Breakout Trading: ong> Enter trades when prices break above resistance or below support levels identified in chart patterns.ong>Retest Strategy: ong> After a breakout, wait for a retest of the breakout level before entering a position.ong>Pattern Confirmation: ong> Look for additional confirmation through volume or other technical indicators.

Market Data and Trends in Vietnam

As the cryptocurrency user base in Vietnam has grown by an astounding 190% in the last year, understanding crypto chart patterns is increasingly crucial for local investors.

Understanding the Local Market

Vietnam’s rapidly expanding crypto market signifies the need for localized education and resources. Traders should seek platforms that offer valuable insights into how to navigate both international and local trends.

Challenges and Limitations of Chart Patterns

Understanding Market Sentiment

While crypto chart patterns can be advantageous, they are not foolproof. Market sentiment, news events, and regulatory changes can significantly impact price movements.

Adapting to Market Changes

It’s essential for traders to adapt their strategies according to changing market conditions and not solely rely on chart patterns.

The Future of Crypto Chart Patterns

As technology and trading strategies evolve, chart patterns will continue to play a critical role in the decision-making process for traders. Educational resources that reference

Final Thoughts

By mastering

For more insights and resources, explore Suzukicoin for the latest information in the crypto world.

The Author

Dr. Ethan Arrow, a seasoned blockchain analyst, has published over 30 papers in fields related to cryptocurrency and trading strategies. He has led audits for prominent projects and remains a trusted advisor within the blockchain community.